idaho property tax relief 2021

If you qualify the property taxes on your home and up to one acre of land may be reduced by as much as 1500. By KEITH RIDLER May 12 2021.

How To Start A Real Estate Business Infographic

You dont need to do anything.

. CuraDebt is a company that provides debt relief from Hollywood Florida. Otto Kitsinger for Idaho Capital Sun. To qualify for a homeowners exemption.

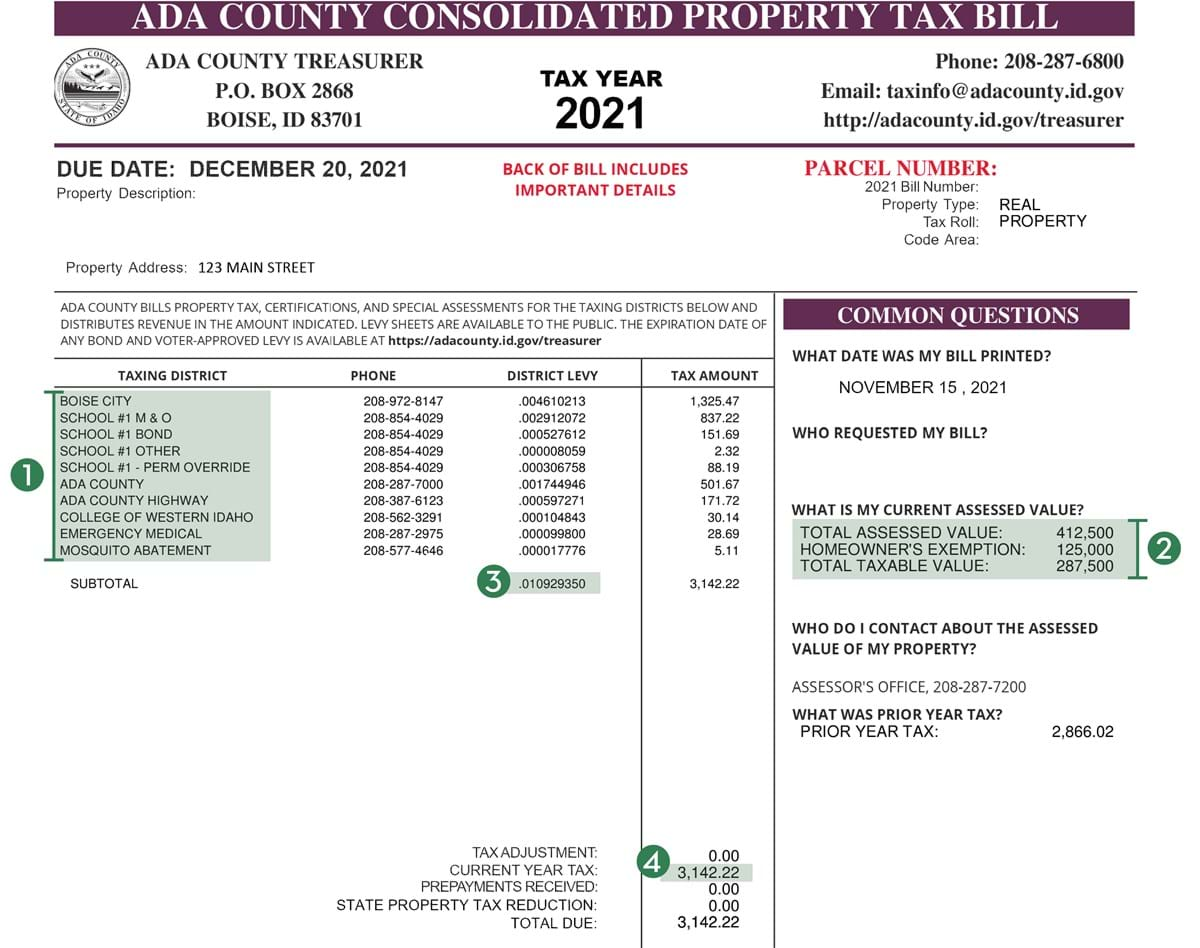

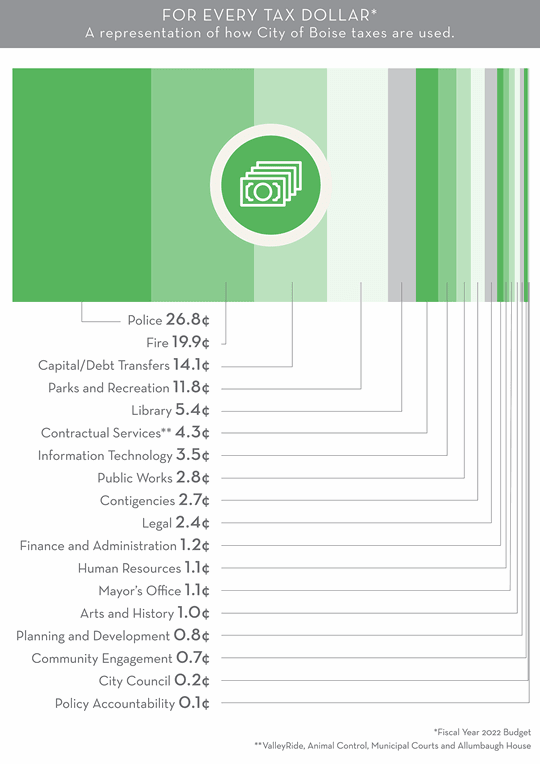

The Idaho State Tax Commission is responsible for approvingdenying applications for property tax relief. For example homeowners of owner-occupied property. Most homes farms and businesses are subject to property tax.

The Veterans Property Tax Reduction benefit reduces property taxes for qualified 100 service-connected disabled veterans. The PTD brochure below has more information including how to file. He told the committee the bill is meant to address several areas of property tax relief while curbing growth i n local municipal budgets.

Never in my life did I think we would achieve the TRIFECTA historic tax relief historic. Brad Little signed a property tax relief bill Wednesday that opponents describe as deeply flawed but supporters say is better than nothing. Brad Little signed House Bill 380 into law Monday providing Idahoans 220 million in immediate one-time income tax rebates and 163 million in ongoing income tax.

Twenty four hours after it first saw the light of day the Idaho House of Representatives passed a sweeping property tax reform package despite bipartisan opposition. Brad Little signed a property tax relief bill Wednesday that opponents describe as deeply flawed but supporters say is better than nothing. Application for Property Tax Reduction 12-30-2021 PTR Medical Expense Statement 12-30-2021.

Friday February 4 2022. Dont Miss Your Chance. BOISE Idaho AP Idaho Gov.

The refunds are part of Governor Littles Building Idahos Future plan to use our. About the Company Idaho Property Tax Relief For Seniors. Theyll help you fill out the application.

526 PM MDT May 12 2021. The Idaho House printed heard and sent a property tax bill to the floor that increases the homeowners exemption from 100000 to 125000. Ad Look Up Any Address in Idaho for a Records Report.

Boise Idaho Governor Brad Little signed the first bill of the 2022 legislative session today his Leading Idaho income tax cut bill that provides one-time and ongoing income tax relief to Idahoans. Once granted a surviving spouse can use this benefit but it isnt. What do I need to do.

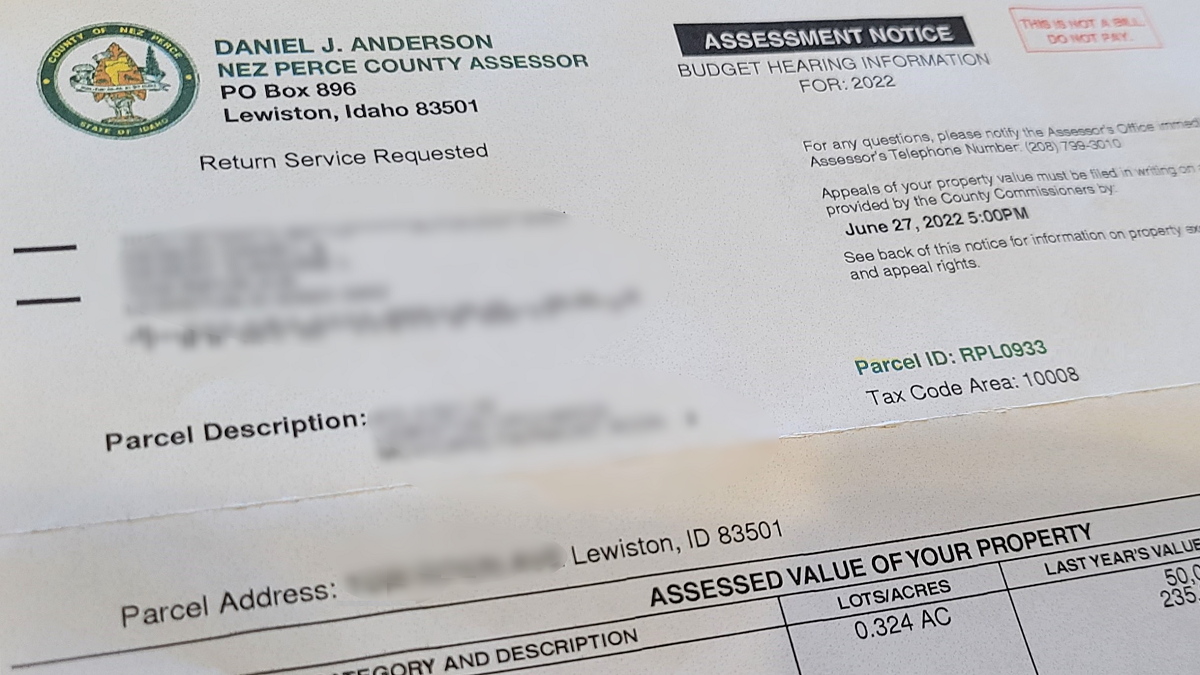

Check Your Eligibility Today. You apply through your county assessors office. The Tax Commission and county assessors manage this program.

BOISE Idaho Idaho Gov. Forest landowners with at least five acres but less than 5000 acres may qualify for the timber exemption as defined in Idaho Code 63-1701. Find Out Whats Available.

Apply through your county assessors office. BOISE Idaho AP Idaho Gov. The Tax Commission administers the program but.

Meet one or more of the following status requirements as of January 1 2022. Ad A New Federal Program is Giving 3252 Back to Homeowners. Home Departments Assessor.

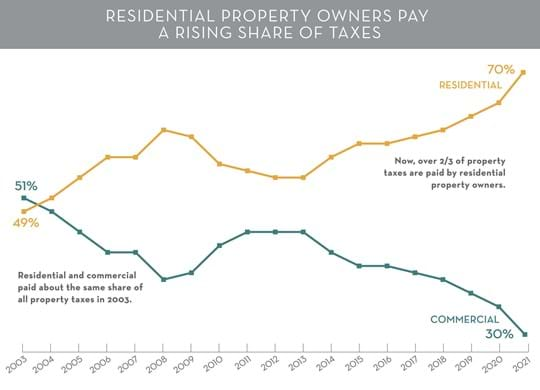

Taxes are determined according to a propertys current market value minus any exemptions. Apply from January 1 through April 18 2022. On Tuesday lawmakers voted 48-20 to approve a package of property tax changes spearheaded by House Majority Leader Rep.

When you file your application you must provide. About the Company Idaho Property Tax Relief. Apply through the county assessors office.

BOISE Idaho KMVTKSVT Gov. Brad Little has signed a property tax relief bill that opponents say is deeply flawed but backers say is better than nothing. CuraDebt is a debt relief company from Hollywood Florida.

Our Search Covers City County State Property Records. Idahos Forest Tax Law. IRS eligible medicaldental and related.

Age 65 or older. 20 rows The homeowners exemption will exempt 50 of the value of your. Boise Idaho Idahoans will begin receiving direct deposits or mailed checks in the form of income tax relief starting next week following the passage of Governor Brad Littles historic tax relief package earlier this year.

I filed my 2021 tax return and want my rebate to apply to the tax I owe. The PTR brochure includes guidelines and how to file. Idahos Property Tax Relief Programs.

The current 100000 exemption is the deduction homeowners can subtract from their assessed property value meaning those with an assessed 400000 house would only be taxed based off 300000 of. Friday July 30 2021. The Republican governor expressed his own doubts in approving the legislation that was rushed through in the final days of the legislative.

Also the Idaho State Tax Commission sets property tax values for operating property which consists mainly of public utilities and railroads. It was founded in 2000 and has been a member of the American Fair Credit Council the US Chamber of Commerce and has been accredited with the International Association of Professional Debt Arbitrators. The program doesnt have an income limit.

The Tax Commission and county assessors administer this program. Check If You Qualify For This Homeowner Relief Fast Easy. The property owner has a choice between two.

Had income of 32230 or less for 2021 and. 2022 Property Tax Deferral Program 11-29-2021. For more information contact your county assessors office or call us at 208 334-7736.

See Results in Minutes. By KEITH RIDLER May 12 2021. It was established in 2000 and is a part of the American Fair Credit Council the US Chamber of Commerce and is accredited by the International Association of Professional Debt Arbitrators.

Well apply your rebate to your 2021 tax after weve processed all payments received in April. Your Idaho drivers license number state-issued ID number or 2021 Idaho income tax return. You can also contact your county assessors office or call us at 208 334-7736.

The Republican governor expressed his own doubts in approving the legislation that was rushed through in the final days of the legislative.

Sticker Shock Idaho Property Owners React To Soaring Assessed Home Values Idaho Capital Sun

It S Tax Time Do You Qualify For A Reduction In Idaho Property Taxes Idaho Capital Sun

Want To Estimate Your Property Tax Bill The Idaho State Tax Commission Has A Tool For That Idaho Capital Sun

Idaho Governor Signs Property Tax Relief Legislation East Idaho News

Kootenai County Property Tax Rates Kootenai County Id

Property Tax Burden Shifting From Business To Residential Coeur D Alene Press

/cloudfront-us-east-1.images.arcpublishing.com/gray/QUYAEQ7YA5DZDF533WMNOBOOKA.jpg)

Idaho Senate Passes Property Tax Reduction For Seniors

Happy Easter Weekend From Our Team At Groupwatson Easterweekend Goodfriday Easter2021

November Home Prices Rose 9 5 One Of The Highest Gains On Record Case Shiller Says Moving To Idaho House Prices Sacramento County

Nez Perce County Residents See Property Tax Values Soar 30 Idaho Bigcountrynewsconnection Com

Idaho Property Tax Assessments Will Likely Be Higher In 2021 Here S What You Need To Know Boise Regional Realtors

There S Got To Be A Better Solution Idaho S County Clerks Lament 2021 Property Tax Bill Idaho Capital Sun